LIFE OUTSIDE THE CITY

Read More about LIFE OUTSIDE THE CITY

Providing specialized products for brokers, banks, and mortgage lenders.

United Ag Lending is a full-service agricultural wholesale lender that specializes in offering solutions to loan officers who have clients needing agricultural loans. We work with brokers and lenders looking to expand their portfolio offerings.

The agricultural industry is unique and requires loan programs that flex to meet the needs of your clients. Working with United Ag Lending allows brokers and lenders to offer a robust agricultural loan program that accommodates clients seeking properties of all sizes and shapes.

Agricultural lending is a specialized service that not many brokers and lenders have the ability to offer their clients.

Working with United Ag Lending allows you to expand your offerings and capture clients you might otherwise not be able to work with by having a specialized farm loan provider on your team.

You need a wholesale agricultural lender that understands what your client needs and has the experience to get your loans closed. Our financing programs are flexible to meet the needs of multiple types of clients with a variety of hobby farm loans, rural residential loans, and full-time farm loans.

Rural property financing and helping your customers achieve their long-term goals is what motivates us at United Ag Lending. Whether your client is at the beginning of their agricultural journey or somewhere in the middle, United Ag Lending provides financing to meet them where they’re at.

Applying for farm loans of any kind can feel overwhelming. But it doesn’t have to be. Get insight into some industry terms with our glossary or get answers to some frequently asked questions below.

No! United Ag Lending has several different loan programs to fit many different scenarios. We can finance homes with land, bare land, and full-time farm loans. So if you have a client looking for country-style living with a home and acreage that they can farm, or if they just want to live outside the city, our programs can help. If they have bare land for future farming, we can help you! If they’re a full-time farmer with a dairy farm, vineyard, poultry farm, tree farm, avocado farm, and many others, we can also help.

No two pieces of land or client circumstances are the same. We evaluate the specific scenario to match clients with the perfect loan program for their needs. Our team of trusted advisors uses our expertise and years of experience to create customized loan solutions.

At United Ag Lending, we offer many different loan programs to fit your clients’ goals, from a minimum of 5 acres of bare land and up, to full-time farms, and even for those who want home and land going up to 160 acres or more.

Yes, we have a minimum credit score requirement of 680. However, on our land and agriculture farm loans, we only require a 680 credit score from one of the three credit bureaus that report it. To learn more about our credit score requirements, talk to one of our experts today.

We can finance land and farm loans up to 30 years fixed-rate with no early payoff penalty. We also offer many other loan terms, including ARMs, to fit your goals and financing needs.

Yes, we can finance multiple parcels of land together, whether they are contiguous or not. This can be done through our commercial farm loan program, our hobby farm loan program, or our rural residential loan program.

No. We are a farm loan provider that focuses on land and pre-existing homes. We don’t offer loans for construction, farming operations, equipment, or livestock.

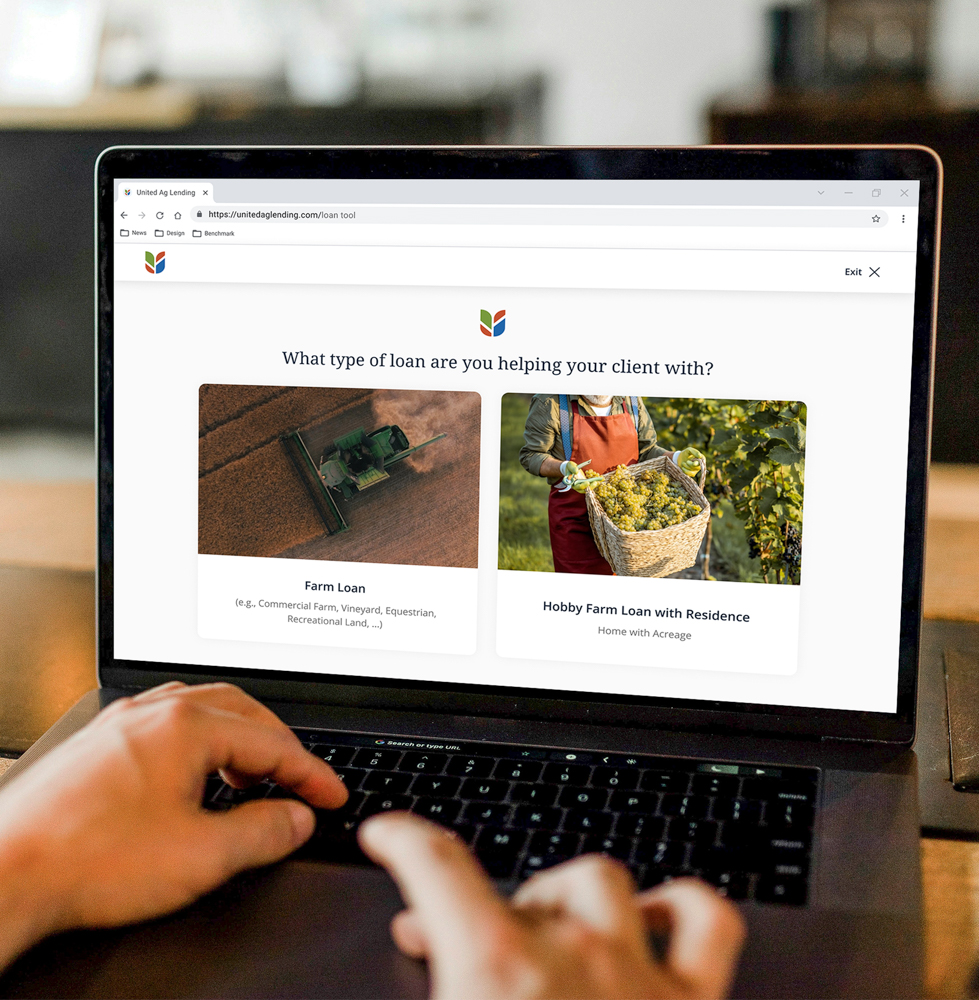

The process is quick and easy. Answer a few quick questions and we’ll determine which loan program is perfect for your client!

LIFE OUTSIDE THE CITY

Read More about LIFE OUTSIDE THE CITY

What Is Hobby Farming & Why Might it be Right for You?

Read More about What Is Hobby Farming & Why Might it be Right for You?

4 Ways to Start Hobby Farming

Read More about 4 Ways to Start Hobby Farming

We say it all the time: no two farming operations are the same, so no two commercial farm loans should be the same. As a farm loan provider, we finance all kinds of industries, such as dairy farms, nurseries, vineyards, orchards, equestrian properties, commercial crops like wheat and cotton—the list goes on. Our commercial farm loans are designed to support your clients with farming business goals.

Our commercial farm loans are great for your clients:

With a variety of commercial farm loans to choose from—including 30-year fixed-rate loans, adjustable-rate loans, cross-collateralization, and more—you can offer your clients a loan that meets their financial needs for expanding their business.

Requirements checklist: