Meet New & Diverse Client Needs

From olives to oranges, an orchard or grove loan can make a big difference for a diverse array of agricultural ventures. United Ag Lending’s unique rural mortgage products make our offerings stand apart from other wholesale lenders and can broaden your client base, thus diversifying your business.

Many individuals dream of moving to the countryside to pursue agriculture, but may not be confident in how to find financing. With support from our customizable loans, you can help new and existing clients realize their aspirations. As one of our lending partners, you’ll have access to a variety of resources and knowledgeable staff members to assist you in the agricultural lending experience.

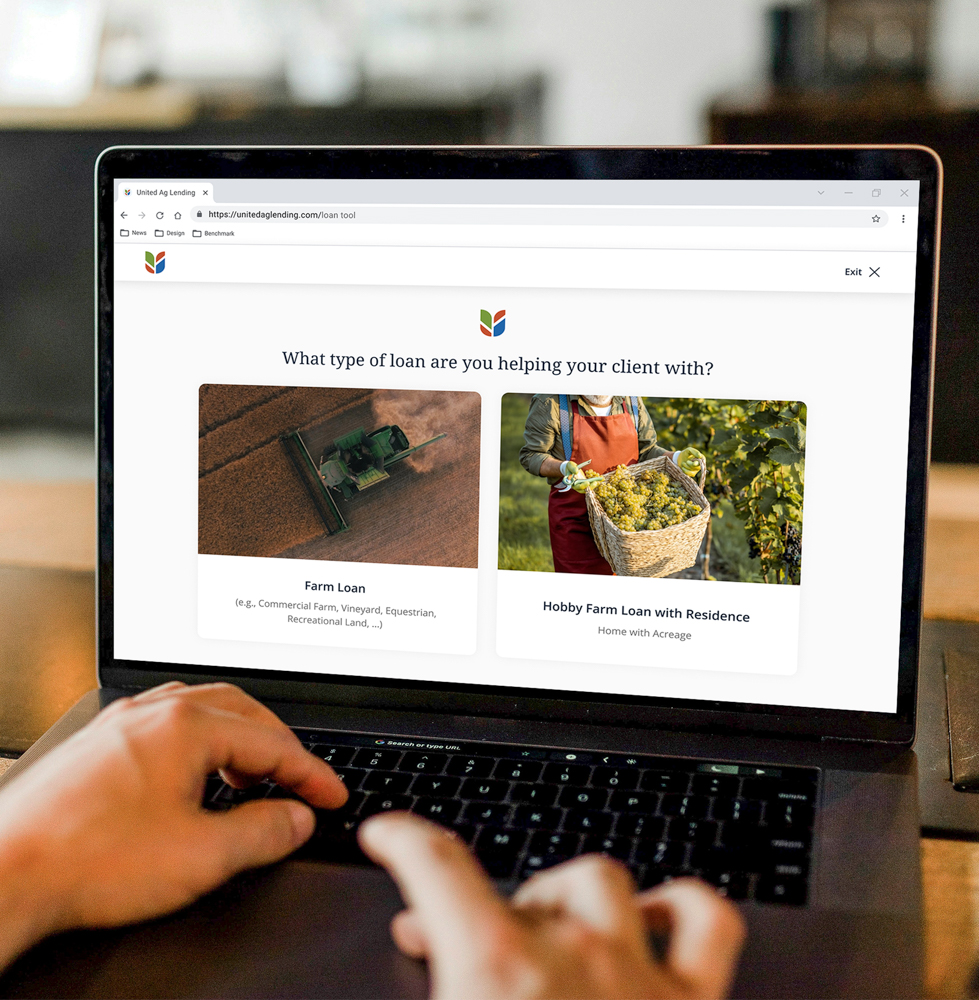

Our efficient system for creating personalized loan products for orchard and grove operations simplifies the process, making it easier to attract new business and support the expansion of current accounts.

-

Step: 1

Consultation

To get the purchasing process started, we’ll begin with an introductory conversation to get to know you and your client’s needs.

-

Step: 2

Recommendations

After getting to know you and your client’s property plans, our loan officers will customize a loan program that fits their goals.

-

Step: 3

Receive Loan

Once your client receives their loan and starts making their plans happen, we will continue being a trusted resource to you.

Orchard and Grove Loans

Most wholesale lenders don’t provide rural mortgage products for orchards, groves, commercial farms, hobby farms, or rural residential dwellings. At United Ag Lending, we specialize in structuring these rural real estate loans. As city natives gravitate towards the slower, sweeter life offered by rural land, they’ll need someone to turn to.

You can effortlessly expand your portfolio by reaching out to our team for information on this industry. Our agricultural and lending experts are passionate about educating more lenders, brokers, and banks about this profitable niche in the mortgage business.

Program Highlights:

- Must have at least 5 acres of land

- While permitted, Ag-exempt properties are not mandatory

- Obtain purchase, rate/term, or cash out refinances for debt payoff, home or land enhancements, or cash on hand

- Unify your land and construction loans with a single permanent mortgage loan

- Primary and secondary homes allowed

- We allow land value to go above 30% of appraisal; other lenders don’t

- Only 25% of the dwelling’s value is needed (less may be accepted depending on the circumstances)

- Several parcels are permitted; nearby ones may be grouped

- Unlimited horse facilities allowed, including both indoor and outdoor arenas

- Properties may include shed homes, barndominiums with standard living spaces, log homes, and multiple dwellings

- Fixed 15- and 30-year terms available

United Ag Lending’s orchard and grove loans offer many advantages to your clients

Unlike traditional wholesale lenders, we offer our customers and partners greater loan flexibility. This is only the start of what our informed support can do for your clients.

-

Loans for a number of different industries: nurseries, orchards, vineyards, dairies, ranches, cattle, and more

-

Making money with their hobby or commercial farm

-

They can own multiple parcels, potentially combining nearby ones

-

Get financing permitting Schedule F (Farm) income

-

Fixed-rate loans up to 30 years with no prepayment penalty or adjustable products

-

Monthly, annual, or semi-annual payment options on commercial loans

We Prioritize Your Clients

From fruits and nuts to shrubs and flowers, orchards and groves offer many lucrative options. Our orchard and grove loans offer vital financing, empowering your clients to cultivate farms according to their unique vision.

Interested in discovering more? Let’s brainstorm the most effective approach to serve your clients and personalize solutions.

Get Started

The process is quick and easy. Answer a few quick questions and we’ll determine which loan program is perfect for your clients!