Advancing Commercial Operations

United Ag Lending is a reputable commercial wholesale agricultural lender.

United Ag Lending is a steady partner for commercial farmers, and our commercial farm loans have been a reliable resource for our partners.

If you have clients who are looking to expand their commercial agricultural business, we’re here to give you a helping hand. For a more in-depth look at our commercial farm loans, get in touch with us.

-

Step: 1

Consultation

We will schedule a consultation with one of our account executives to better understand your client’s needs.

-

Step: 2

Loan Analysis

We’ll discuss their financial needs and farming operation plans.

-

Step: 3

Amazing Results

After our meeting, we’ll provide customized loan product rates and recommendations and stay by your and your customer’s side throughout the rest of the loan process.

Commercial Farm Loans

Our commercial farm loans are ideal for a wide range of commercial operations. Whether your customer is looking to buy additional land to expand their operation, increase their farm capital, or refinance debt, we can help! Our program offers farmers the agriculture financing needed to accomplish their business goals.

With a variety of commercial agricultural loan programs, including 30-year fixed-rate loans, we can meet a variety of financial needs to expand businesses or help finance agricultural operations from year to year.

Program Highlights:

- Minimum loan amount: $500,000

- Fixed-rate loans from 10 years to 30 years fixed

- 1-year to 15-year adjustable rates are available

- Minimum acreage: 10 acres

- Multiple properties or contiguous parcels

- Outbuildings, sheds and other land improvements allowed

Explore Lending Options

Make agricultural lending smoother—for you and your borrowers.

Commercial Farm Loan Partnerships

As a specialized wholesale commercial farm loan provider, our team has a flexible approach to loan solutions. Our focus is providing wholesale agricultural real estate products, meaning we aren’t distracted by originating other mortgage loans. This allows us to truly serve as a unique, invaluable partner for brokers, banks, and mortgage lenders.

United Ag Lending’s partners benefit from our expertise in the agricultural industry and have access to our customized loan products. Our programs are essential to building a solid farming client base, helping those involved with our commercial farm loan partnerships cultivate new relationships that can expand their business.

Financing Your Unique Commercial Project

Our team understands that all commercial farming projects are different. United Ag Lending can offer your customers a commercial loan product that addresses their proposed project and meets their financial needs.

Our keen attention to detail allows us to create substantial commercial farm loan partnerships. We will take note of these details to ensure we can meet all your customers’ needs during the lending process:

- Client requests

- Land size

- The type of property/properties needed to address their farming needs

- Your client’s credit score

After distilling this information, we will present unique commercial loan products with personalized loan terms.

Trusted Experience

United Ag Lending’s exceptional lending team has years of experience serving people in the agricultural industry. This experience has helped us cultivate essential relationships in the field that enrich our knowledge and enhance the loan products we produce.

In addition to knowing what farming customers need, we have also developed a set of core principles that guide what we do and continue to propel our company forward:

-

Communication

Our commercial farm loan partnerships are successful because we listen and communicate clearly.

-

Endurance

We continue to find success in this field thanks to what we’ve learned and our drive to keep improving our processes.

-

Simplicity

Our loan solutions are flexible, customized, and straightforward. We won’t waste your or your customer’s time with complicated solutions.

More Commercial Loan Details

-

- Loans for a number of different industries: logging, equestrian, annual crops, permanent plantings, nurseries, orchards, vineyards, dairies, ranches, cattle and more

- Fixed-rate loans up to 30 years with no prepayment penalty or short-term adjustable products

- Monthly, annual, or semi-annual payment options

- Loans up to 70% of value offered

- And more

-

Our team takes our reputation and yours very seriously and understands how essential our commercial farm loan partnerships are to both businesses. To help ensure you benefit from our collaboration, we give our lender partners access to our whole suite of lending programs. Our unique solutions are unlike others in the industry and are essential to attracting clients who want to expand their agricultural real estate portfolio.

-

Brokers and lenders looking to offer a unique product for their clients and expand their business find an excellent partnership with United Ag Lending.

Being a dynamic commercial wholesale agricultural lender means that we have the flexibility to offer our partners much more than they would find at a traditional wholesale lender. We’ve broken down the barriers that stand in the way of our partners’ success, and this continues to fuel our progress.

We’re taking conventional methods and turning them into simplified solutions that work for our partners, rather than the other way around.

-

With a growing history of success as a commercial wholesale agricultural lender, we’re acutely aware of how important it is for our partners to work with a lender that understands the industry. We’re an ideal wholesale partner for brokers and lenders looking to provide their clients with access to a robust, flexible agricultural wholesale lending company.

Working with a commercial wholesale agriculture lender ought to be a simple process. We’re proud to say that we’ve managed to simplify the complexities of agricultural lending, and our partners’ success is evidence of that.

Get in touch with us today, and we’ll help you find the easiest path forward to help your business grow with a commercial farm loan program.

Get Started

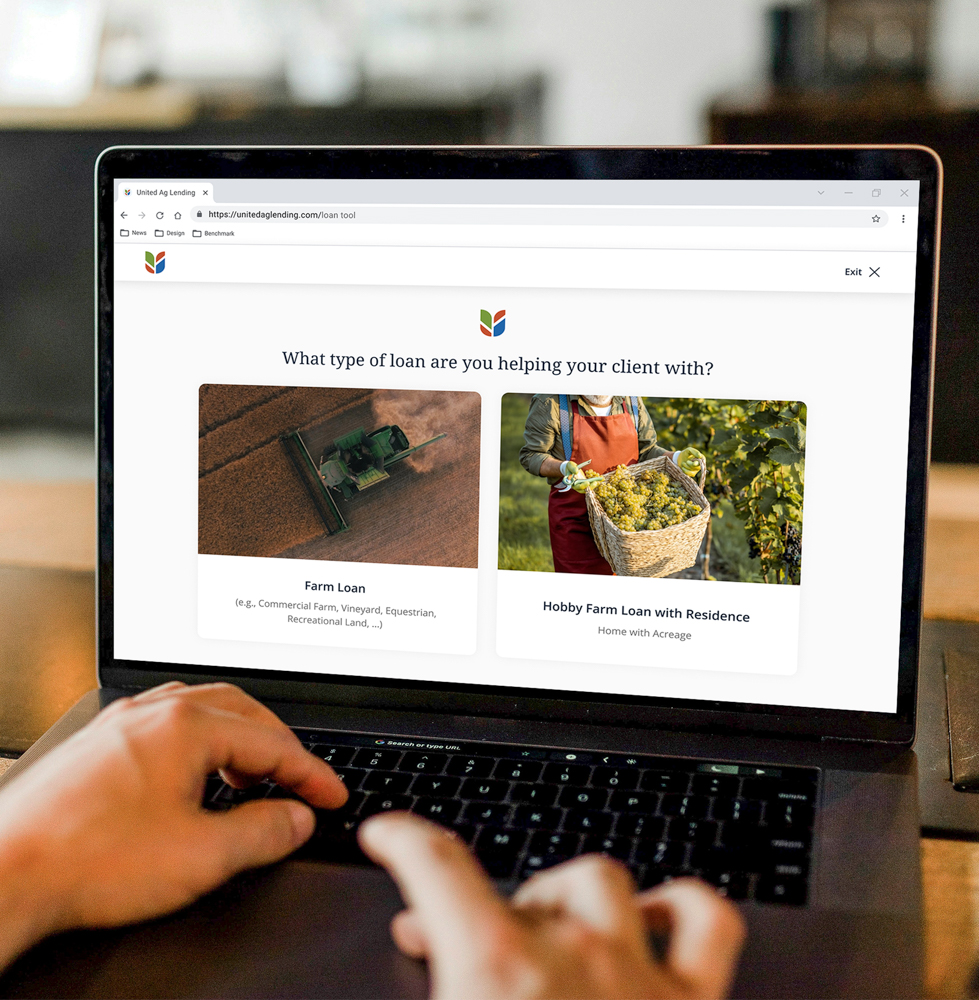

The process is quick and easy. Answer a few quick questions and we’ll determine which loan program is perfect for you!