Help Your Clients Settle Down With United Ag Lending

Finding a forever home is a significant investment. Not only that, but it comes with a host of questions from your clients.

We are proud to work as a wholesale partner for brokers and lenders looking to expand their portfolios and offer more opportunities for their clients.

Our rural residential program is well-suited for your clients looking to settle down on their own private property. Our team is ready to help you support your clients in finding the proper rural home loan for their needs.

-

Step: 1

Consultation

To get the purchasing process started, we’ll begin with an introductory conversation to get to know you and your needs.

-

Step: 2

Recommendations

After getting to know you and your client’s property plans, our loan officers will customize a loan program that fits their goals.

-

Step: 3

Receive Loan

Once your client receives their loan and starts making their plans happen, we will continue being a trusted resource to you.

Rural Residential Program

Our rural home lending programs are meant to be a flexible, simple process. They’re also a unique product that we offer, and we rival our competitors in terms of what we can empower our partners to accomplish!

If your client’s ideal situation is to buy rural land with an existing home on the property, this is the loan for you to offer them.

Program Highlights:

- Minimum of 5 acres

- Fixed-rate 15- and 30-year loans with low rates available

- Ag-exempt properties allowed but not required

- Purchase, refinance, and cash out loans offered

- Owner-occupied and second homes allowed

- Barndominiums, shed homes, and shop homes allowed

- 5 to 160 acres (home value only required to be 30% of overall value)

- Homes with pasture land and tillable acreage

- Schedule F (Farm) income allowed

The Benefits of Our Rural Home Loans

Whatever dreams your clients have in mind, our rural home loans are an essential part of bringing those dreams to life. We intend to be a flexible asset that works on your behalf, rather than the other way around.

-

15- and 30-year fixed-rate loans

-

Purchasing, refinancing, and cash-out loans

-

Barndominiums, shed homes, and shop homes allowed

-

Up to 160 acres of land (the home value is only required to be 30% of the overall property value)

Partner With United Ag Lending

When you’ve got clients looking to live the rural lifestyle on a property with a pre-existing home, we have the resources and expertise to help you provide.

If you’re ready to start exploring our rural home loans and what they can do for your clients, get in touch with your AE, and we’ll be more than happy to work with you as an expert rural home wholesale lender.

Get Started

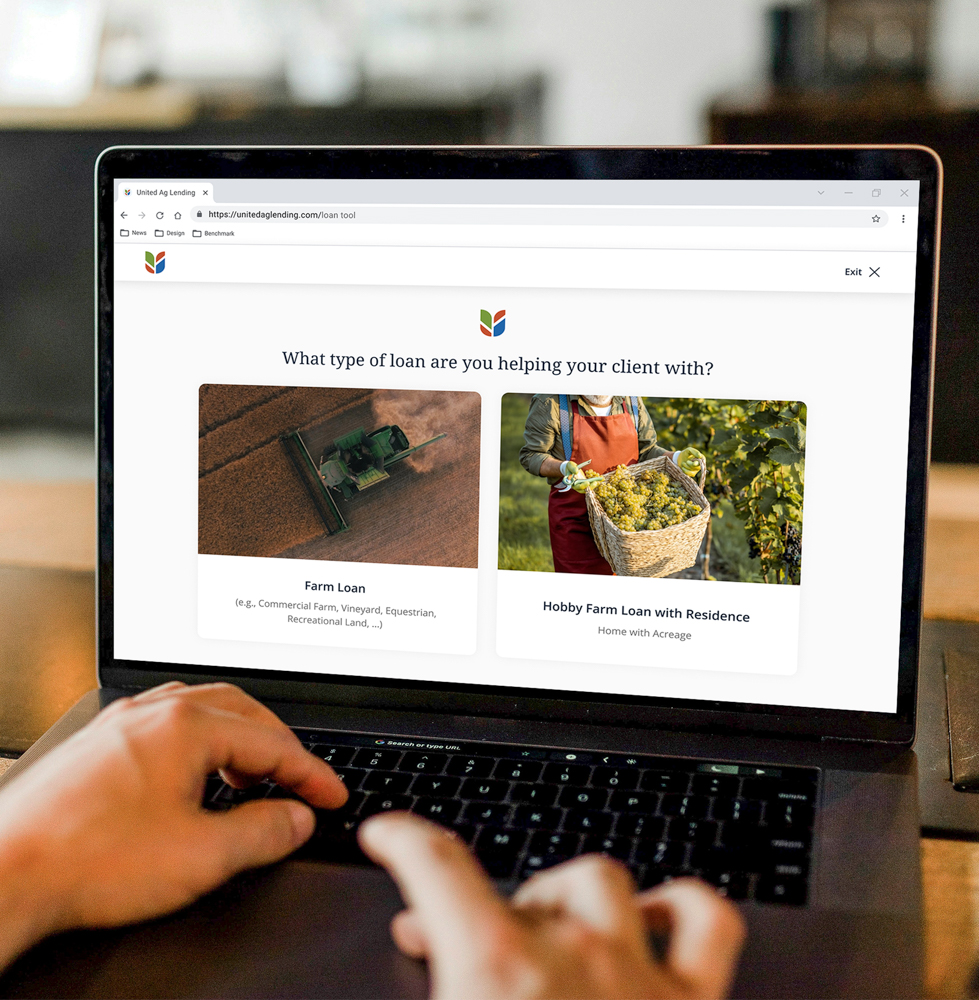

The process is quick and easy. Answer a few quick questions and we’ll determine which loan program is perfect for your client!