Unlock New Opportunities for Your Clients

Farm and ranch loans are an impactful resource to diversify your business and help more clients. Most wholesale lenders don’t provide rural mortgage products, making our services a unique opportunity for you and your clients.

Don’t let financial restrictions hinder your clients’ applications for agricultural loans; United Ag Lending offers a solution. Partner with us, and we’ll help your clients achieve their agricultural dreams.

Our streamlined process simplifies the development of tailored loan products for farms and ranches, making it easy to attract new clients and help existing clients grow.

-

Step: 1

Consultation

To get the purchasing process started, we’ll begin with an introductory conversation to get to know you and your client’s needs.

-

Step: 2

Recommendations

After getting to know you and your client’s property plans, our loan officers will customize a loan program that fits their goals.

-

Step: 3

Receive Loan

Once your client has received their loan and they start making their plans happen, we will continue being a trusted resource to you.

Farm and Ranch Loans

As more people embrace rural life, agricultural lending becomes an increasingly attractive field. Unfortunately, obtaining farm loans can be less than clear. Through our specialized loans, United Ag Lending helps your clients easily access the agricultural lifestyle.

We customize the conventional understanding of mortgage loans to create a solution tailored to rural needs. We empower our partners with more flexible loan programs tailored to rural properties, in contrast to the typical constraints imposed by wholesale lenders.

Program Highlights:

- Down payments as low as 25%

- Fixed-rate loans from 10 years to 30 years fixed

- Minimum loan size: $500K

- 1-year to 15-year adjustable rates are available

- Minimum acreage: 10 acres

- Multiple properties or contiguous parcels

- Outbuildings, sheds and other land improvements allowed

United Ag Lending’s farm and ranch loans open numerous benefits for your clients

Your clients’ needs guided the creation of these loan products. This is just the beginning of the possibilities that our informed support can offer your clients.

- Loans for many industries: nurseries, orchards, vineyards, dairies, ranches, cattle, and more

- Making money with their hobby or commercial farm

- They can own multiple parcels, potentially combining nearby ones

- Get financing permitting Schedule F (Farm) income

- Fixed-rate loans up to 30 years with no prepayment penalty or adjustable rate products

- Monthly, annual, or semi-annual payment options on commercial loans

Putting Your Clients First

From sprawling orchards to thriving livestock, your clients’ farm dreams are within reach with our support. By providing crucial financing, our farm and ranch loans give your clients the autonomy to run their farms their way.

Want to learn more? Let’s discuss the best approach to serving your clients.

Your Unrealized Potential

There’s a high demand for rural properties, but traditional wholesale lenders are not prepared to accommodate them. By capitalizing on this gap, you can set your brokerage, lending, or banking services apart. We’re a wholesale lender specializing in ag financing for mortgage brokers, mortgage lenders, and banks. We’re here to help you discover untapped profits!

Get Started

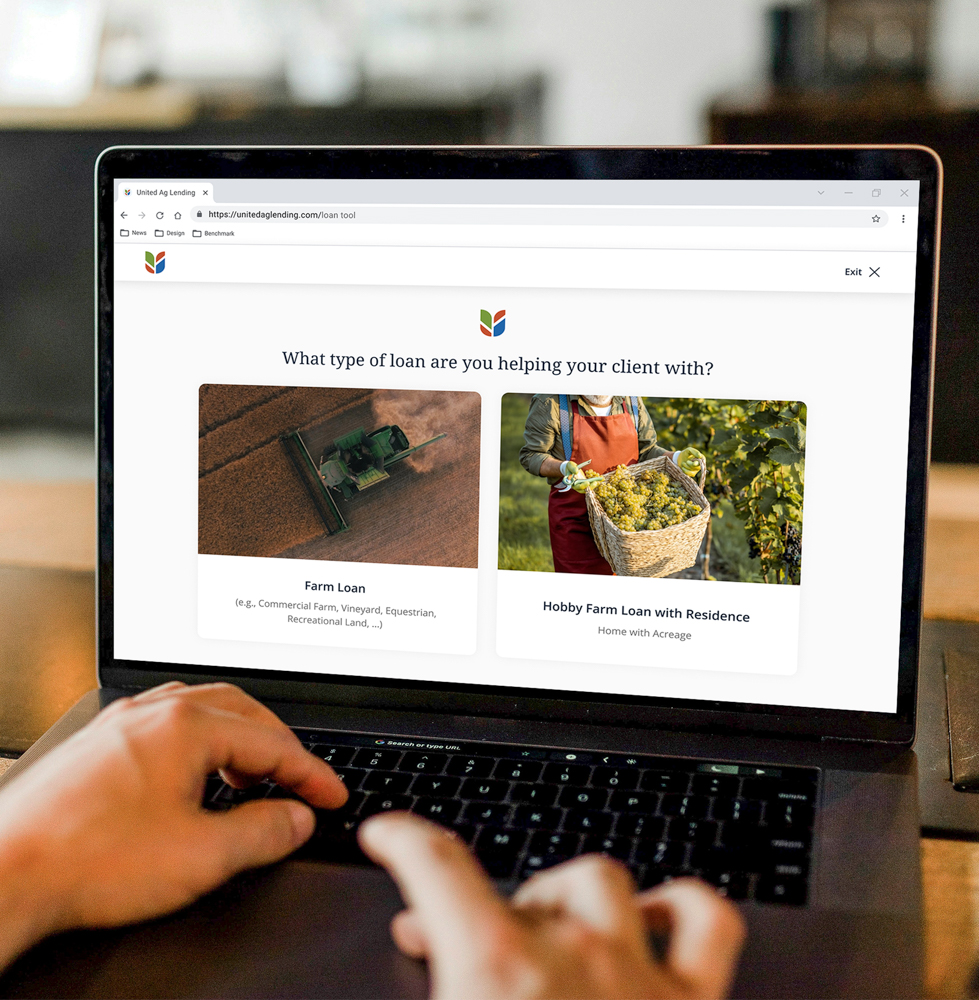

The process is quick and easy. Answer a few quick questions and we’ll determine which loan program is perfect for you!